www.bmf.cpa

Lease Accounting: Not As Far Away As It Seems

With the massive changes coming to revenue recognition, it’s easy to forget that there are also some significant changes to lease accounting closely following. The new lease standard supersedes FASB ASC 840 and becomes effective for non-public companies for annual periods beginning after December 15, 2019 (i.e., calendar periods beginning January 1, 2020), and interim periods after December 15, 2020.

Although this might seem distant, implementation of this standard will require significant lead time, which many companies are not planning for. That’s why it is crucial for any organization with leases to acquire a deep understanding of the changes now and formulate an action plan for timely implementation.

The Changes – In A Nutshell

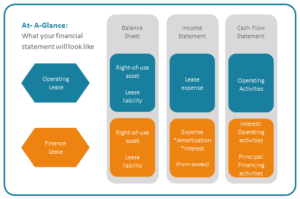

Today, operating leases are “off-balance sheet” obligations. Only capital leases, which are those leases meeting certain criteria resembling financed asset purchases, are capitalized on the balance sheet. In an effort to provide more transparency into all of an organization’s obligations, the new standard seeks to put the large majority of operating leases onto the balance sheet with both an asset (the right to use the leased item) and liability (the obligation to make lease payments), similar to the way capital leases are presently accounted for.

The balance sheet is not the only financial statement impacted by the new standard. The new accounting guidance prescribes different methods for recognizing the expenses associated with leases, which often may accelerate recognition of expense. Currently, operating lease expenses are charged to net income on a straight-line basis, over the life of a lease. Under the new standard, leases will be accounted for as if a company had borrowed funds to purchase an interest in the leased asset, which will accelerate expense in most cases.

How You Can Prepare

Beginning implementation of the new lease standard will be a huge undertaking for many organizations. The two major hurdles for many companies will be gathering all leases and identifying the different lease components in a contract so they can be accounted for separately. Here’s what you can do now:

• Take an inventory of ALL leases

• Identify internal stakeholders/task force, including real estate, treasury, accounting, etc.

• Initiate dialog with your BMF advisors

• Consider how financial statements, ratios and debt covenants may be impacted

• Assess system & third-party provider readiness.

• Implement controls and centralize your lease process

Where Your Business Can Feel the Impact

• Internal analysis and decision-making

• Changes to banking arrangements

• Increased accounting efforts and potential software investment

• Tax planning

• Consolidation of related entities

• Revenue Recognition for nonprofit entities

Many companies have limited resources and/or accounting staff are engaged with other regulatory obligations, so implementation may be more complicated than it appears. Because companies need to apply the new lease standard just one year after the FASB’s new revenue standard, timing the transition is critical.

Take control of your 2020 financial reporting and start preparing today. If you would like to discuss next steps or ways to help lessen the burden, contact us.