www.bmf.cpa

IRS Issues Transitional Guidance on Meals & Entertainment Deductions

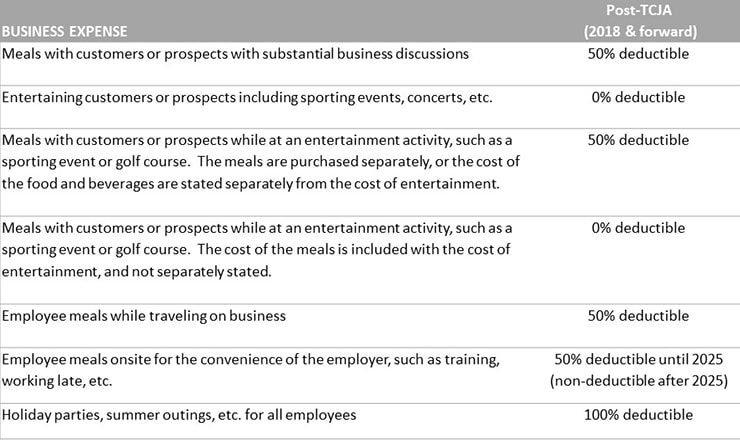

As we noted in our March Tax Reform Series #5 Advisor, the TCJA amendment caused significant confusion regarding the deductibility of meals that occurred before, after or during the entertainment. IRS Notice 2018-76 was issued to provide transitional guidance that will be used until proposed regulations are published by the U.S. Department of the Treasury and the Internal Revenue Service. These new proposed regulations will clarify when business meal expenses are nondeductible entertainment expenses, and when they are 50% deductible expenses.

The following is transitional guidance that may be used in determining the deductibility of business meals until the proposed regulations are issued.

Under Notice 2018-76, taxpayers may deduct 50% of an otherwise allowable business meal if:

- The expense is an ordinary and necessary expense, paid or incurred during the taxable year in carrying on any trade or business;

- The expense is not lavish or extravagant under the circumstances;

- The taxpayer, or an employee of the taxpayer, is present at the furnishing of the food or beverages;

- The food and beverages are provided to a current or potential business customer, client, consultant or similar business contact;

- In the case of food and beverages provided during or at an entertainment activity, the food and beverages are purchased separately from the entertainment, or the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts. The entertainment disallowance rule may not be circumvented through inflating the amount charged for food and beverages.

Notice 2018-76, also includes a statement that the U.S. Department of the Treasury and IRS intend to issue separate guidance addressing the treatment of expenses for food and beverages furnished primarily to employees on the employer’s business premises.

We will be watching for the release of the additional guidance.

We can help clarify questions on these limitations or best practices for capturing these expenses.

Melissa G. Dunham?>

CPA, MTax, MBA

Robert M. Burak?>

CPA

About the Authors

Subscribe

Stay up-to-date with the latest news and information delivered to your inbox.